Unit-linked

Life insurance

YOUPLUS Assurance AG

Austrasse 14, 9495 Triesen

LIECHTENSTEIN

+423 239 30 30

support@youplus.liPrivate Placement

Life Insurance

YOUPLUS Assurance AG

Austrasse 14, 9495 Triesen

LIECHTENSTEIN

+423 239 30 96

info@youplus.liAbout us

Unit-linked life insurance

(formerly Aspecta)

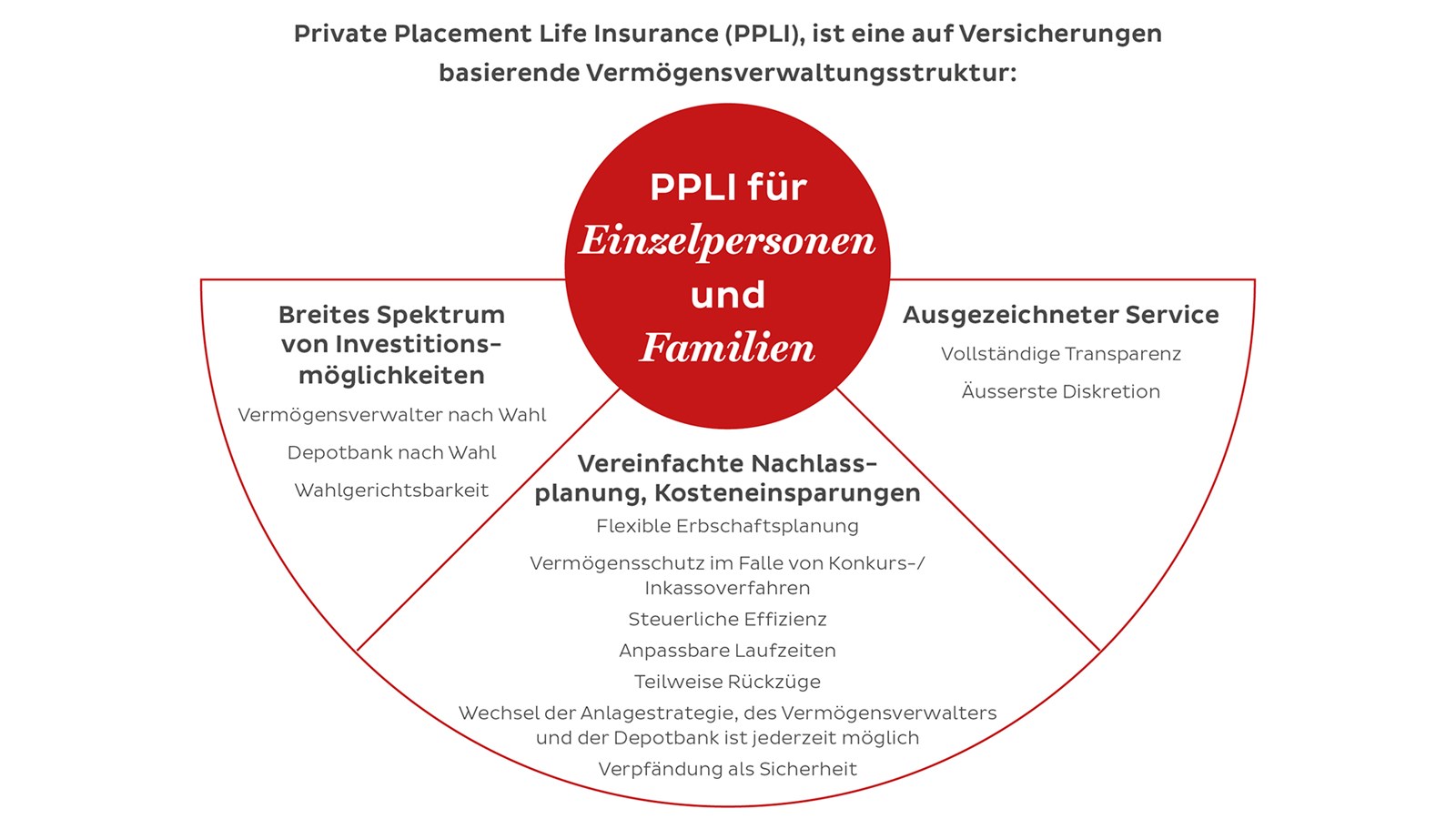

Private Placement Life Insurance

(PPLI)